UnionBank U Visa Platinum

| Annual Fee | Free |

| Min. Annual Income | ₱ 180,000 |

| Interest Rate | 3% |

Card Details

- No annual fees for life!

- Earn a 10% rebate on interest charge when you pay at least the minimum amount due on or before the due date

- No overlimit and late fees

- Ideal for: cardholders who prefer cards with less fees

UnionBank U Visa Platinum

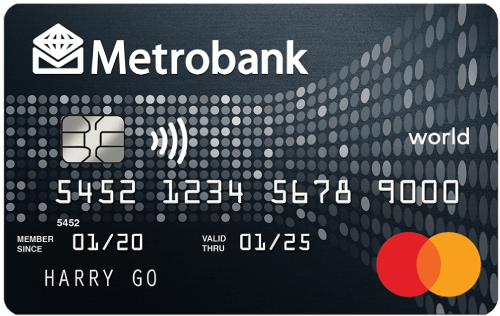

Metrobank Platinum Mastercard®

| Annual Fee | Free |

| Min. Annual Income | ₱ 700,000 |

| Monthly Effective Interest Rate | 3% |

Card Details

- No annual fees for carded first-time Metrobank cardholders when you apply until October 31, 2024 and meet an annual spend of ₱400,000.

- Earn 1 reward point for every ₱20 spend

- Up to 50% off on premium dining offers

- eCommerce purchase protection up to $200

- No annual fee for your first supplementary card

- Ideal for: premium dining perk seekers

Metrobank Platinum Mastercard®

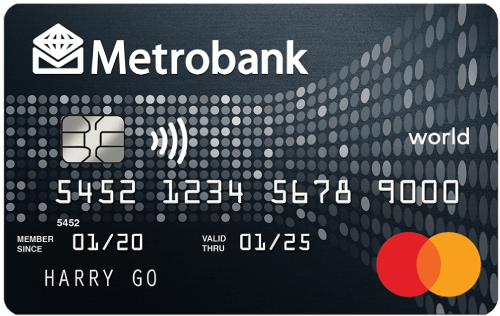

Metrobank World Mastercard®

| Annual Fee | Free |

| Min. Annual Income | ₱ 1,500,000 |

| Monthly Effective Interest Rate | 3% |

Card Details

- No annual fees for carded first-time Metrobank cardholders when you apply until October 31, 2024 and meet an annual spend of ₱800,000.

- Get 2x reward points for international purchases

- Earn 1 reward point for every ₱20 spend

- Enjoy up to 50% off on luxury dining deals

- Ideal for: frequent travelers and premium perk seekers

Metrobank World Mastercard®

More Ways to Use Your No Annual Fee Credit Card

Building or Improving Credit

No annual fee cards are ideal for those looking to build or improve their credit history without incurring additional yearly costs. Regular on-time payments on these cards contribute positively to your credit score.

Earning Rewards and Cashback

Many no annual fee cards offer rewards on everyday purchases, such as cashback on groceries, dining, or fuel. This allows you to earn points or cashback without worrying about offsetting an annual fee.

Secondary or Backup Card

These cards work well as a backup for emergencies or larger purchases, adding a safety net without extra financial commitment. They can also help increase your overall credit limit, which may improve your credit utilization rate and credit score.

Financing Large Purchases with Intro APR Offers

Many no annual fee cards come with 0% introductory APR on purchases for a limited time. This can be helpful for financing larger purchases, allowing you to pay off the balance over time without accruing interest during the intro period.

Travel Benefits without Extra Costs

Some no annual fee cards offer travel perks, such as no foreign transaction fees, basic travel insurance, or rental car coverage. These features allow you to enjoy travel-related benefits without the expense of an annual fee.

How to Get a No Annual Fee Credit Card in 3 Simple Steps

Obtaining a no annual fee credit card is generally a simple process, which can be broken down into three easy steps

Research and Compare Options

Submit Your Application

Approval and Activation

No overdraft Fees

Top credit card questions

A no annual fee credit card is a type of credit card that doesn't charge an annual fee for card membership. You can use the card for purchases and earn rewards or benefits without worrying about paying a yearly fee.

While there is no annual fee, some no annual fee cards may charge other fees, such as late payment fees, foreign transaction fees, or cash advance fees. It's essential to read the terms and conditions to understand all potential charges.

No, qualifying for a no annual fee credit card is generally similar to qualifying for any other credit card. The primary factor is your credit score and financial history.

Yes, using a no annual fee credit card responsibly (paying bills on time, keeping your balance low, etc.) can help build or improve your credit score over time.

Some no annual fee credit cards offer basic travel benefits, such as no foreign transaction fees or trip delay coverage. However, premium travel benefits (like travel insurance and lounge access) are typically reserved for cards with an annual fee.

Yes, many no annual fee credit cards offer rewards, such as cashback, points, or miles, on eligible purchases. However, the rewards program may not be as lucrative as cards with annual fees.

No, credit limits on no annual fee credit cards are generally based on your creditworthiness, not the card’s fee structure. However, cards with higher annual fees may offer higher limits and better perks in exchange.

A no annual fee card doesn’t charge a yearly fee, while a low-interest credit card typically offers a lower interest rate on purchases and balances. Some low-interest cards may still charge an annual fee, but the APR is more favorable for carrying a balance.

To avoid paying interest, always pay off your balance in full before the due date. If you carry a balance, you'll accrue interest, which could negate any benefits of having no annual fee.

It depends on your spending habits. Having multiple no annual fee credit cards can help you maximize rewards in different categories and increase your credit limit. However, managing multiple cards can become cumbersome, so it’s important to track spending and payments.